Table of Contents

- Introduction

- College is a good investment

- College graduates get higher-quality jobs

- College graduates fare better during recessions

- College is more expensive than ever

- But most students don’t pay the sticker price

- Public college students have less debt

- Public and nonprofit colleges are a better financial bet

- Finishing a degree is important

- Majors matter for future earnings

- Wage inequities persist

- Society benefits from higher education

- More students need a chance at college

- Additional figure notes

We explore whether the benefits of a college degree outweigh the costs.

Although most California parents (71%) want their children to graduate from college with at least a bachelor’s degree, about seven in ten (69%) worry about being able to afford a college education. Sticker shock and an understandable reluctance to take on debt lead many students and parents alike to wonder if college will actually yield higher earnings, better jobs, and a brighter future down the road.

College is a good investment

Over the last decade, the college wage premium—the difference in wages between college graduates and comparable high school graduates—has plateaued at historically high levels. In 2023, workers with a bachelor’s degree earned on average 61 percent more than high school graduates (compared to 40% more in 1990), while those with graduate degrees earned 89 percent more (60% in 1990).

California workers with a bachelor’s degree earn a median annual wage of $90,000; only 5 percent of workers without a high school diploma and 12 percent of those whose highest level of education is a high school diploma earn as much. Indeed, bachelor’s degree holders in the bottom quarter of the wage distribution earn more than 75 percent of workers without a high school diploma and half of workers with at most a high school diploma.

College graduates get higher-quality jobs

Beyond wages, the job market favors college graduates in other ways as well. Graduates are more likely to participate in the labor force, less likely to be unemployed, and more likely to have full-time jobs. Among full-time workers, college graduates are more likely to have jobs that offer paid vacation, health insurance, retirement, and flexible work arrangements. These forms of non-wage compensation help provide greater financial stability and security over the long run.

The long-term view is critical. The college wage premium increases steadily over a person’s career as workers with college degrees obtain jobs in professional occupations with more opportunity for on-the-job learning and wage growth.

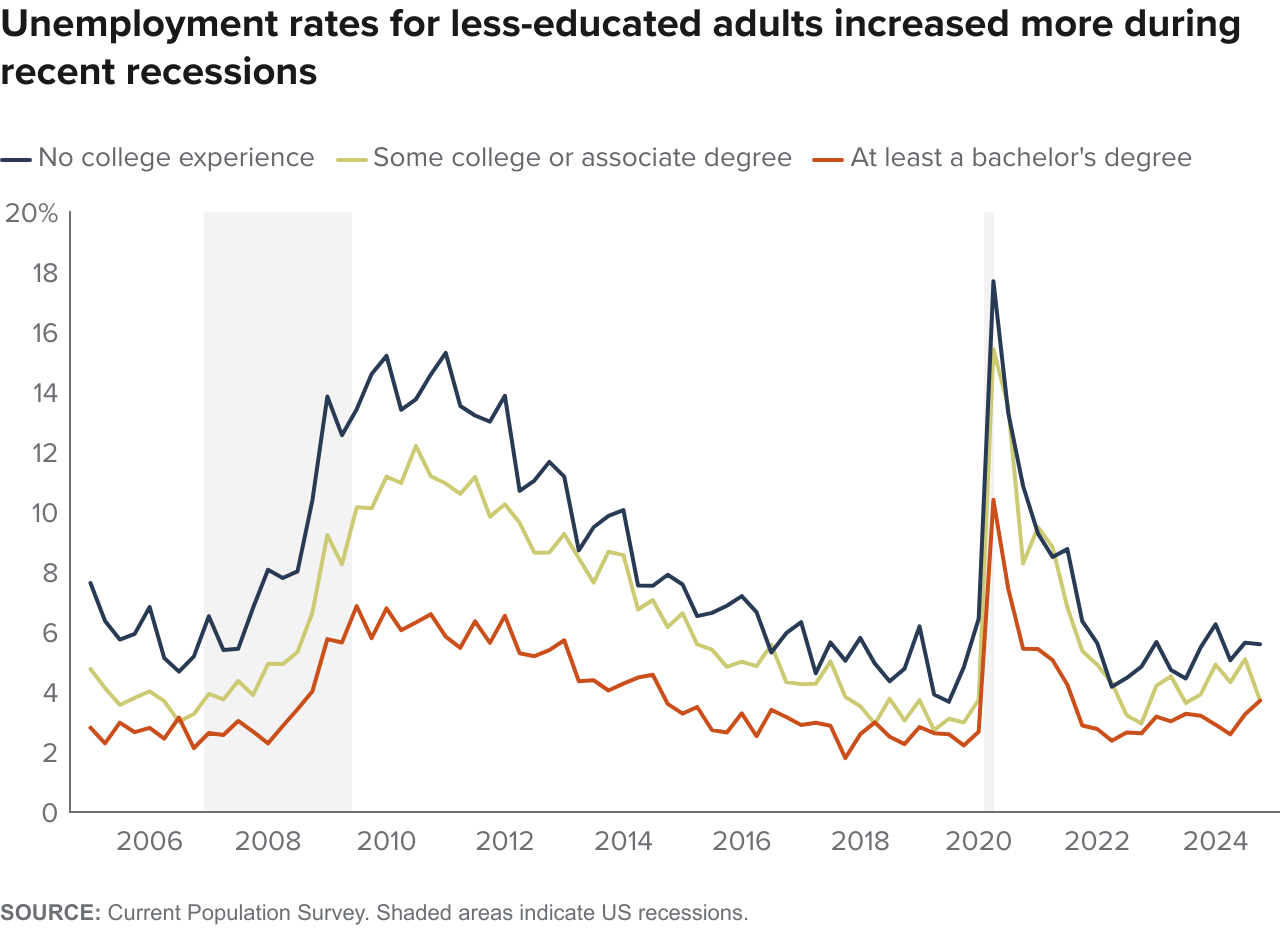

College graduates fare better during recessions

College graduates not only earn higher wages and have higher-quality jobs, they are also better protected during economic downturns. In the past several recessions, less-educated workers have borne the brunt of employment losses. During the worst of the COVID-19 recession, the unemployment rate for those with no college experience was 18 percent, compared to 10 percent for those with a bachelor’s degree.

College is more expensive than ever

Students who want to reap the benefits of college face rising costs. After adjusting for inflation, average costs have increased by 37 percent across the state’s four-year and public two-year institutions over the last 20 years. In 2023–24, a nonprofit private college in California cost full-time undergraduates living off campus an average of $75,000 per year, including tuition, room and board, books, and other fees. Public colleges are far less expensive, but prices have still gone up—reaching nearly $38,000 per year at the University of California (UC), $33,000 at California State University (CSU), and $29,000 at the California Community Colleges (CCC).

Housing—not tuition—is the key driver of rising costs at public colleges. After accounting for inflation, public four-year tuition is actually lower now than it was five years ago thanks to increases in state funding, though future tuition increases may reverse this trend. Many students save significantly by living with family, especially at CCC (nearly two-thirds of aid recipients live with family) and CSU (half do so). For students living off campus but not with family, food and housing make up 71 percent of total expenses at CCC, 56 percent at CSU, and 40 percent at UC.

But most students don’t pay the sticker price

Financial aid in California is very generous and can reduce costs tremendously, especially for students from low-income families. A CSU student whose family earns less than $30,000 pays on average $6,200 in annual college costs, compared to $20,500 for a student whose family income exceeds $110,000. At UC, the range is even larger, from $9,000 for the lowest-income students to $31,500 for the highest-income students.

Financial aid fully covers tuition for many students, especially those attending public colleges. But nontuition costs remain high. For families earning under $30,000, attendance costs after financial aid amount to about a fifth of their annual income for CCC, a quarter for CSU, and a third for UC.

Public college students have less debt

An estimated 30 percent of California students at four-year universities took out student loans in 2022–23, lower than the national rate of 43 percent. Overall, public college students are less likely to take out federal, institutional, or private loans. About a quarter of CSU and UC students did so in 2022–23, compared to 43 percent of students at four-year nonprofit private colleges and almost two-thirds at four-year for-profit colleges. Median debt amounts are also lower among students from public institutions.

Public and nonprofit colleges are a better financial bet

Students from for-profit colleges—disproportionately Black and Latino students—are the most likely to have loans that are delinquent or in default. These statuses can damage credit scores, leading to higher interest rates and reduced access to mortgages and car loans.

Notably, the majority of students at for-profit colleges never graduate, and those who do have lower wages than other graduates. In contrast, public four-year colleges serve high proportions of low- and moderate-income students but still have a strong track record of students being able to recoup their educational costs.

Finishing a degree is important

Students who never finish their degree do not see the same wage bump as college graduates. This financial loss is compounded for those who took out loans to attend college in the first place. Three years after college, 22 percent of non-graduates have loans that are in default or delinquent, compared to 12 percent of graduates. Earning a degree in a timely manner is also important, as those who take longer than four years to complete their degree face extra schooling costs, run the risk of losing financial aid eligibility, and further delay their entry into the workforce.

Majors matter for future earnings

The wage benefits of a college degree differ considerably across majors. Graduates in engineering and computer science earn a median wage of $120,000 annually, almost double what graduates in education make ($68,000). There is also a great deal of variation within majors: the top-earning graduates in health make $130,000 annually (75th percentile), twice as much as the lowest-earning graduates in health ($65,000 for the 25th percentile).

Wage inequities persist

Although workers across gender and racial/ethnic groups see a wage premium for earning a college degree, marked disparities still exist in the labor market. Male workers with a bachelor’s degree have a median annual wage of $100,000, compared with $80,000 for college-educated female workers; the gender gap is similar across education levels. Likewise, white workers make more than Black and Latino workers across all levels of educational attainment.

Several factors contribute to these gender and racial pay gaps, including labor market discrimination, field of study, institution attended, and eventual occupations. Further, the underrepresentation of female, Black, Latino, and lower-income students in the most financially rewarding programs of study affects later job prospects, earning potential, and upward mobility.

Society benefits from higher education

Higher education is a critical driver of economic progress. It is also the key policy lever for improving mobility from one generation to the next, especially for low-income, first-generation, Black, and Latino students. As the state’s economy has evolved, the job market has increasingly demanded more highly educated workers, a trend that is projected to continue.

In addition to having higher earnings and better job benefits, college graduates are more likely to own a home and less likely to be in poverty or need social services. Society as a whole is also better off, thanks to lower unemployment, less demand for public assistance programs, lower incarceration rates, higher tax revenue, and greater civic engagement.

More students need a chance at college

A college degree does not guarantee financial security, but for the vast majority of students it represents their best chance of achieving economic prosperity. Improving access to college-level information on costs of attendance, graduation rates, and jobs, wages, and career paths in different fields could help students and families make more informed decisions.

Although the state has made enormous progress, more work is also needed to improve student success at key transition points, including high school graduation, college enrollment, transfer, and college completion. If current enrollment and completion rates continue, most California 9th graders will not earn a bachelor’s degree. And at every step along the way, low-income students—who account for more than half of the state’s public K–12 students—are less likely than their higher-income peers to make it to and through college. Unfortunately, a similar story holds true for other underrepresented groups.

California and its higher education systems have already made tremendous strides in expanding access and improving completion so that more students can enjoy the benefits of a college degree. At the PPIC Higher Education Center, we are tracking the impact of these historic investments and policy changes, working to ensure that they have their intended effects, and advancing evidence-based solutions to further enhance educational opportunities for all California students.

Topics

Access Affordability Completion Equity Finance Higher Education Workforce NeedsLearn More

The Economic Milestones of Young Californians

New Data on College Completion Shows Room for Improvement

Work Experience and Field of Study Matter for Graduates’ Earnings

Room for Progress in College Graduates’ Transition to the Labor Market

College Affordability in California

College Completion in California